Housing | Programs

Inclusionary Housing

The City requires all new residential developments with 50 or more housing units to sell at least 10% of their units at an affordable price for low- to moderate-income residents. Homeowners can earn equity on the property while the homes remain affordable for a minimum number of years before they can be sold at market rate. Prospective buyers may qualify for down payment and closing cost assistance. For more information, contact the Tallahassee Lenders' Consortium at 850-222-6609 or email kmiller@tallahasseelenders.org.

Eligibility

Total household income must be 100% of the area median income (AMI) or less, adjusted for family size, as defined by the U.S. Department of Housing and Urban Development. Applicants must demonstrate proof of income.

New Home Infill Program

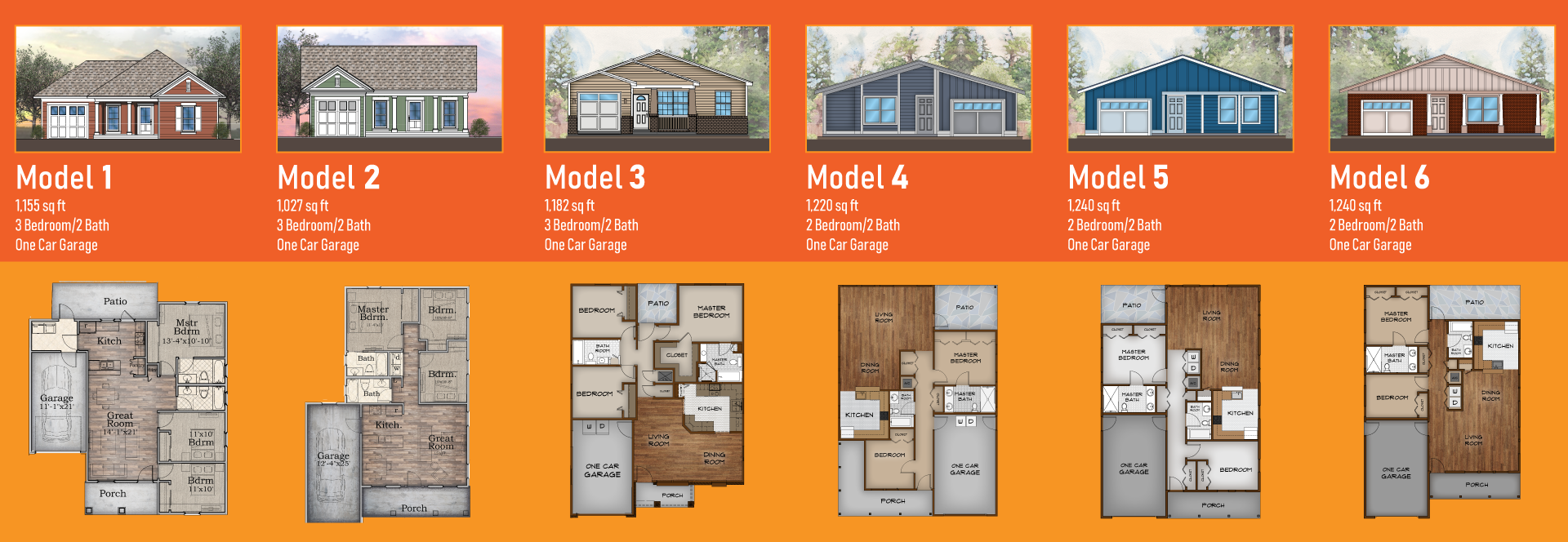

The New Home Infill Program, developed at the direction of the Community Redevelopment Agency (CRA) Board, is designed to help alleviate the shortage in availability of housing and provide a pathway to home ownership for low to moderate-income residents of Tallahassee. The CRA Board commissioned the six house plans below to fit into the aesthetic of established neighborhoods. In addition, the City also contracts to build new homes on infill lots using these and similar plans through its work with CHDO's, the CLT, and local contractors. Incentives to developers and homebuyers are available in connection with the purchase of the newly built home

Click the image to see a larger view.

Multiple lots have already been identified and are highlighted on the map linked below.

Designated New Home Infill and CLT Lots Map

If you would like to find out more information about how the City's new construction projects might be right for you, please fill out the contact form below or email the City's Housing division.

Contact Form

Down Payment Assistance

The City offers down payment and closing cost assistance to help low-income residents to purchase an affordable home and to start a path towards building equity and wealth. The program is administered by the Tallahassee Lenders' Consortium (TLC) on behalf of the City. TLC also provides homebuyer education, credit and finance counseling and assistance in selecting a mortgage lender.

Eligibility

Total household income must be 80% of the area median income (AMI) or less, adjusted for family size, as defined by the U.S. Department of Housing and Urban Development. Applicants must demonstrate proof of income, be approved for a first mortgage through a qualified lender and attend TLC's homebuyer education classes. The total amount of DPA will be determined based on need.

Visit https://www.tallahasseelenders.org/down-payment-assistance/ to learn more. Interested buyers may submit a pre-application through the City's application portal.

Community Land Trust

Tallahassee launched its first Community Land Trust (CLT) in March 2020 in partnership with Leon County and the Tallahassee Lenders' Consortium. A CLT is a nonprofit entity governed by community stakeholders that can build and preserve affordable housing and can help stabilize neighborhoods by reducing the negative impacts of gentrification. In a traditional real estate sale, the owner owns the building and the land it sits on. CLTs keep homes affordable by leasing the land and selling only the house for low- to moderate-income people. Under this model homeowners can earn a portion of the equity on their home and eventually go on to buy a market rate home, while the CLT is able to keep the home affordable for the next owner. Eligible buyers must qualify at or below 80% AMI and be approved for a first mortgage. Down Payment Assistance is also available.

Contact the Tallahassee Lenders' Consortium at 850-222-6609 x100 for more information.

Construction Loan Program

Private developers may apply for a short-term construction loan to build affordable single-family homes (including duplexes, triplexes, and quadraplexes). Loans carry an annual interest rate of below the 'prime rate' as reported by The Wall Street Journal (WSJ). The loans are due and repayable to the City within 18 months from the date of the loan agreement (24 months for rehabilitation projects) or 6 months following the issuance of Certificate of Occupancy (CO), whichever occurs first.

- Maximum loan of $200,000 per project for one project at a time

- Eligible uses for the funds include construction and major rehabilitation of single-family homes for resale to eligible buyers qualified at or below 100% AMI

- Units must be located within the City limits

In addition to the loan, the City may offer other incentives to developers such as expedited permitting, and a waiver of water and sewer system and tap fees for homes whose purchasers have been identified upfront and whose income is at or below 80% AMI.

Eligibility

- Must be a private developer or contractor that is licensed and insured to perform such work.

- Must demonstrate capacity to develop affordable single-family housing units and/or experience working with the targeted homebuyers at 100% AMI or less.

- Must submit audited financial statements or those prepared and signed by a Certified Public Accountant to demonstrate capacity to carry the loan and complete the proposed home construction in the event costs exceed the maximum $200,000 loan amount.

- Projects must be shovel ready with permittable plans.

Funding is provided through various sources including the City’s Affordable Housing Trust Fund, the Community Redevelopment Agency (for those located in a CRA District), U.S. Treasury American Rescue Plan Act funding (special allocation), and the City’s Neighborhood Affairs Division (for those located in a neighborhood with an Approved Neighborhood First Plan). Applications are received on a rolling basis as funds are available. Apply online through the City's application portal.

Habitat City Build

Since 2017, the City Commission has partnered with the Big Bend Habitat for Humanity to construct affordable homes through a revolving fund supported by the State Community Contribution Tax Credit Program (CCTCP). Tallahassee was one of the first cities to engage in this innovative partnership with Habitat and has since inspired several others across the state. In addition to the financial contribution, City employees and other volunteers have provided hundreds of hours of volunteer labor to build 2-3 homes each year for fellow neighbors in the community.

Home Repair/Resiliency Program

The purpose of the Home Repair Program is to improve the living conditions of low-income homeowners by removing health and safety hazards and by correcting exterior code violations. The program provides up to $25,000 in a forgivable loan to assist low-income property owners. The zero-interest loan requires no monthly payments. If the homeowner continues to occupy the home for a minimum of 7 years after the repairs are complete, then the loan amount is forgiven.

Typical repairs include:

- Plumbing repairs

- Structural repairs to the roof, ceiling, walls, floors, stairs, etc., where hazards exist

- Roof repair or replacement

- Heat repair or installation

- Electrical repairs where hazards exist

- Exterior painting

- Rafters, soffit and fascia repair

- Windows and screens

- Railings and stairs

- Landings and porches

- Yard clearings and debris removal when done in conjunction with repairs to the home

- Removal of hazardous trees

- Elevate at-risk hot water heaters and HVAC units in flood-prone areas

Eligibility

To receive assistance, the applicant must own and reside at the property located within the City limits. The household income cannot exceed 50% Area Median Income or 80% Area Median Income if a household member is special needs or disabled. The home must be homesteaded and the market value as determined by the Leon County Property Appraiser cannot exceed the HOME Maximum Purchase Price Limits as determined annually by HUD.

Applications are received on a rolling basis as funds are available with priority given to those with special needs. Apply online through the City's application portal.

Home Rehabilitation Program

The goal of the Home Rehabilitation Program is to enhance and strengthen neighborhoods and preserve existing housing stock through rehabilitation. The program provides up to $75,000 in a forgivable loan to address significant improvements with priority for health and safety hazards. The assistance is provided in the form of a zero-interest loan that requires no monthly payments. If the homeowner continues to occupy the home for a minimum of 10 years after the repairs are complete, then the loan amount is forgiven.

The rehabilitation is completed in partnership with community agencies and typically includes:

- roof replacements,

- window repair/replacement,

- flooring replacement,

- bathroom modifications, or

- plumbing replacement

Eligibility

To receive assistance, the applicant must own and reside at the property located within the City limits. Homeowners must have an income that does not exceed 50% Area Median Income or 80% Area Median Income if a household member is special needs or disabled. The home must be homesteaded and the market value as determined by the Leon County Property Appraiser cannot exceed the HOME Maximum Purchase Price Limits as determined annually by HUD.

Applications are received on a rolling basis as funds are available. Apply online through the City's application portal.

Home Accessibility Program

The Home Accessibility Program removes architectural or structural barriers from the homes of disabled persons. Up to $15,000 is provided through local partners such as the Center for Independent Living (Ability 1st) to make handicap accessibility improvement. Typical repairs include installing:

- wheelchair ramps,

- hand railings and grab bars

- raised countertops and other kitchen modifications,

- wider doorways, and

- ramps for easy ingress/egress.

Eligibility

To receive assistance, the applicant must own and reside at the property located within the City limits. Homeowners must have an income that does not exceed 50% Area Median Income or 80% Area Median Income if a household member is special needs or disabled. The home must be homesteaded and the market value as determined by the Leon County Property Appraiser cannot exceed the HOME Maximum Purchase Price Limits as determined annually by HUD.

Applications are received on a rolling basis as funds are available. Apply online through the City's application portal. Call the Center for Independent Living, also known as Ability 1st, at 850-575-9621 or visit https://www.ability1st.info for more information.

The City of Tallahassee has established a Landlord Risk Mitigation Fund (Fund) to support local landlords who agree to partner to provide housing stability for vulnerable and at-risk tenants. The Fund is designed to provide some assurances to landlords who rent to tenants that are facing eviction or are ending their homelessness. Participation in the Fund represents a partnership between property owners, housing service providers, and tenants. In addition to financial incentives, the program supports landlords and tenants with individualized community-based services and consultations to reduce tenant turnover and avoid costly and detrimental evictions.

Learn more about the program. Applications are received on a rolling basis as funds are available. Apply online through the City's application portal.

How to Apply

Applying for assistance is as simple as a phone call or click away! You can apply online for through the City's application portal.

The application portal is CLOSED for the City’s Owner Occupied Repair, Rehabilitation, and Reconstruction Programs and will remain closed until further notice.

If you need assistance applying, please contact the Housing Division at housing@talgov.com or call 850-891-6566 to speak with staff.

General Income Eligibility Guidelines

2025 Income Limit by Number of Persons in Household*

| |

Percent of AMI |

Number of Persons in Household |

| 1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

| Extremely Low Income |

30% |

$19,400 |

$22,950 |

$25,050 |

$27,800 |

$30,050 |

$32,250 |

$34,500 |

$36,700 |

| Very Low Income |

50% |

$32,350 |

$36,950 |

$41,550 |

$46,150 |

$49,850 |

$53,550 |

$57,250 |

$60,950 |

| Low Income |

60% |

$38,820 |

$44,340 |

$49,860 |

$55,380 |

$59,820 |

$64,260 |

$68,700 |

$73,140 |

| Low-Moderate Income |

80% |

$51,700 |

$59,100 |

$66,500 |

$73,850 |

$79,800 |

$85,700 |

$91,600 |

$97,500 |

| Moderate (City Funded Programs) |

100% |

$64,625 |

$73,875 |

$83,125 |

$92,313 |

$99,750 |

$107,125 |

$114,500 |

$121,875 |

| Moderate |

120% |

$77,640 |

$88,680 |

$99,720 |

$110,760 |

$119,640 |

$128,520 |

$137,400 |

$146,280 |

*Sources: For income limits for a specific program funding source, refer to the following links:

CDBG | HOME | SHIP | ESG | HUD HOME Rents | HUD HOME Maximum Purchase Price Limits

Frequently Asked Questions

| Question |

Answers |

| How do I know if I'm eligible to apply ? |

Generally, to be eligible to apply, you must not exceed income limits, the home must be your primary residence, property taxes must be current, and home within the city limits. |

| Can the city housing programs fix my roof? |

Yes, if you are eligible and are income qualified, a housing representative will call you to schedule an appointment for a site inspection of your home to access the damage. |

| How do I apply? |

For most programs you can apply online here. |

| Will the City repaint my house? |

Generally, no. Repair programs are intended to repair health and safety hazards in the home or on the homeowner's property or bring a very deteriorated home into compliance with the City building code. |

| I own a rental unit. Will the City repair my rental unit? |

Most repair programs are currently for persons who own their home and live in it as their primary residence. However new programs to assist owners of small rental units (single family, duplex, triplex, quadraplexes) are under development. |

| I am a tenant. Is there a program to make repairs to rental units? |

Yes, your landlord may apply for the City’s Rental Rehab Loan Program and the Landlord Risk Mitigation Fund. Both programs benefit landlords and owners of rental units within the City of Tallahassee. Apply online for these programs. |

| If I am over the maximum income for Housing Programs, are there other City programs that I can apply for? |

Yes, the City offers many other grant and loan programs available through the City Utility and Customer Service Departments. Call 850-891-4968, or go to Talgov.com/YOU for more information |

Housing Division

Department of Housing and Community Resilience

435 N. Macomb Street, 3rd Floor | Tallahassee, FL 32301

Office: 850-891-6566 | Fax: 850-891-6592

|