FY17 Approved Budget

TABLE OF CONTENTS |

ORGANIZATIONAL OVERVIEW |

FINANCIAL POLICIES |

OPERATING BUDGET |

CAPITAL BUDGET |

FINANCIAL SCHEDULES |

APPENDIX

Mayor and City Commissioners,

It is my pleasure to present for your consideration a balanced budget for fiscal year 2017 (FY17). The goal set forth was to develop a budget that reflects the priorities and values of the entire community while maintaining expenses at the current level and not increasing the millage rate. I’m proud to report that we were able to accomplish those objectives, while also decreasing both the overall budget and the total General Fund budget.

The Fiscal Year 2017 (FY17) General Fund budget totals $145.9 million, $3.2 million less than the FY16 budget.

Expenditures in the General Fund have been budgeted to remain level with FY16’s budget, with the reduction in total funding possible because of the re-organization, added efficiencies and a decrease in the number of full time positions. In the coming fiscal year, the savings from these changes will help offset any increases incurred, allowing total expenses to remain level.

By streamlining resources, the City continues to further enhance services, improve operations, and achieve economies of scale. For example, divisions within Public Works were merged into various utility departments to align similar functions, resulting in a reduction in administrative costs and streamlining the accounting functions related to billing of project work between the General Fund and these enterprise funds. Similarly, strategic planning and crew dispatch techniques are shortening response windows and more closely coordinating activities like street pavement cuts for water service and street patching by public infrastructure. Opportunities to enhance efficiencies were also identified within StarMetro that resulted in a savings of $1.26 million.

Overall, the total proposed City budget, including the General Fund and Enterprise Funds, totals $701.5 million.

Tallahassee is a unique municipality and one where residents enjoy a high quality of life. We operate 77 parks, a municipal utility, the airport, two golf courses and several local cemeteries. Fire services extend beyond jurisdictional lines, and many of our other offerings are used and enjoyed by people who reside outside the city limits. Despite nearly half of our area’s property being off the tax roll due to state-ownership or exemption, Tallahassee ranked among the lowest in Total Municipal Costs in the annual municipal cost comparison with 12 similar Florida cities. This means that our citizens pay less for city services than most other peer cities across the state. By continuing to refine our processes, I am confident that we will continue to be able to offer citizens high quality services at a low cost.

To ensure this budget was a true reflection of our community’s priorities, the City was aggressive in its efforts to enhance the budget planning process this year. Efforts included coordinating a peer review by professionals in the field of budgeting and open government. This review provided recommendations on the process, where improvements could be made and how it can be more transparent.

To increase transparency, the City introduced an online portal, providing citizens with direct access to the City’s financial information.

With a commitment to the Commission and to citizens, a strong focus was placed on participation and dialogue from City leaders and citizens, while being transparent and forthcoming with information throughout the process. Regular updates were provided to the Commission, and meetings were held with citizen groups and community stakeholders, all of which created new opportunities for discussions regarding different elements in the budget.

In addition to surveying residents online, a statistically valid phone survey was conducted as part of the planning process. It revealed that, overall, residents who live in Tallahassee are very happy with the quality of services provided, with 82 percent of respondents rating services as either “excellent” or “good.” Citizens overwhelmingly reported that their top priorities are safety and infrastructure/facilities maintenance.

The proposed budget reflects these priorities and allocates our limited resources in a way that will meet the expressed needs of the community.

In the face of crime in our community, citizens feel that it’s more important than ever to provide adequate resources for the Tallahassee Police Department. Residents expressed that it is the most important area in which to spend taxpayer dollars. The budget includes $55,069,707 dedicated to TPD. Police patrol will be fully staffed in FY17, and overtime will be reduced by $343,000. The five-year outlook for TPD includes grant funding for 15 additional police officers in FY18 and the reduction of 10 police positions in FY21 through attrition as grant funding for officers is reduced.

The fire services fees, which were approved by the City Commission in 2015, were designed to remain in effect through the end of FY20. The projections for FY17 show that the current fees will adequately fund the Tallahassee Fire Department, including adjustments to personnel costs in accordance with the collective bargaining agreements.

Street preservation and maintenance is a core function of local government, and feedback from residents indicates that it should be a main priority for the City of Tallahassee. Residents expressed that it is the second most important area in which to spend taxpayer dollars. To ensure that our roads are properly maintained, a focus has been placed on restoring funding for general government capital projects, with $5.9 million allotted for capital projects (roadway, sidewalk and traffic infrastructure) in FY17.

As the City faced budgetary constraints over the years, funding for general fund capital projects were reduced in order to balance the general fund budget. Based on citizen feedback and City Commission direction, the proposed budget being presented seeks to restore the funding of general government capital projects to an annual $5-7 million investment.

Staff is currently exploring opportunities to improve the traditional way that road maintenance needs have been addressed. The goal is to move from a “worst first” approach, which typically required the most costly treatments for repair, to a pavement assessment management system that will identify the right fix for the right road at the right time in an effort to extend the roadway life at a lower cost per unit.

Similar program planning is being initiated to develop a more organized and effective sidewalk maintenance program to ensure the posterity of our nearly 500 miles of sidewalks.

StarMetro, the City’s public transit service, provides fixed route, university, paratransit and community transportation services. On average, StarMetro provides 4 million trips annually. It is a key public service, providing transportation to many citizens who have no other option to access employment, training, healthcare, etc. As is common with most bus/transit systems nationwide, it is supported by the General Fund. This year’s proposed contribution is $1.3 million less than FY16. This reduction is a reflection of a concerted effort by staff to operate a more efficient system with the dissolution of the Venom Express, route restructuring, fuel and maintenance savings and elimination of positions. At the same time, efforts are being made to increase the frequency of stops during peak time, decrease wait times and improve connectivity to better serve customers.

The budget also includes funding for community organizations and partnerships, including $2 million toward the Community Human Services Partnership. This represents an increase of $596,792 toward ensuring that the City is funding agencies that provide critical services to some of Tallahassee’s most vulnerable residents and neighborhoods.

While the local economy has not fully recovered from the economic downturn, the City is in a position to move away from reliance on one-time revenue sources and other actions that were necessary during the recession. This budget begins to take a long-view for City services, setting the stage for how we provide services and allocate resources for the next 3-5 years.

Included in this five-year outlook are annual 2 percent raises for non-union employees to help the City retain and recruit top quality people. As is evidenced in this budget, City employees provide excellent services at a low cost to citizens, and they continue to overcome challenges without compromising the level or quality of service. General Fund divisions will be required to strategically reduce costs to offset the 2 percent increase in salaries for non-union employees and a 4.5 percent increase in healthcare costs.

Beginning in FY17, the five-year plan includes the restoration of governmental capital funding, starting with $5.9 million in FY17; increased support for public safety; and no additions in full-time equivalent employees (FTEs) for the stated time period.

Residents of Tallahassee enjoy an unmatched quality of life, and the vast majority is extremely satisfied with City services, as reported in the recent surveys. This is the result of leadership from the City Commission and the commitment of employees. This budget reflects the community’s desire to invest in public safety and infrastructure to meet our current needs and lay the groundwork for years to come.

Throughout the coming year, staff will continue to close out the City books quarterly and provide Commissioners with frequent budget reports in public meetings. Additional methods for receiving citizen feedback will be developed and implemented. It is our goal to ensure the overarching values of the majority of our citizens are reflected in the level and quality of services provided.

Respectfully submitted,

Ricardo Fernandez

City Manager

1.0 ORGANIZATIONAL OVERVIEW

The fiscal year 2017 budget reflects the priorities of the City Commission and the community by maintaining expenses at the current level, restoring funding for road and sidewalk repair and reducing taxes. Commissioners expressed a desire to focus on restoring funding for capital projects to adequate levels in FY17 and for the next five years. This is in line with the community’s expressed desire to support infrastructure and will ensure that roads and sidewalks are properly maintained and that necessary improvements can be done. Respondents in a recent citizen survey reported that infrastructure and roads were two of the top items that should be funded. To help foster a more business friendly environment, Commissioners approved the elimination of the business tax starting in FY18. According to The Greater Tallahassee Chamber of Commerce, Tallahassee would be the first city in Florida to eliminate the tax resulting in an approximate $2,000,000 tax reduction impacting more than 12,000 area businesses.

As part of the effort to enhance the City's budget process, local Florida government professionals in the field of budgeting and open government conducted a Peer Review of our City's budget process on February 12-13 of this year. The City Manager organized the evaluation to obtain feedback and recommendations on the current process, to determine where improvements can be made, and to ascertain how the overall process can be made more transparent. Results of the report have been presented to staff and the City Commission. The Office of Financial Management worked throughout FY16 to implement the recommendations of the Peer Review process and will continue to do so in FY17 and beyond.

1.1 Download the Independent Peer Review

After a series of budget workshops, updates, agendas and public hearings, the City Commissioners adopted the fiscal year 2017 (FY17) budget on September 28, 2016. The operating budget totals $700.6 million, of which $151.6 is in the general fund and the capital budget for FY17 totals $143.4 million. Additionally, in accordance with Florida Statute 200.065, Commissioners approved the FY17 millage rate, reducing it from 4.2000 to 4.1000 mills, which is nearly a million dollars in savings for commercial and residential property taxpayers. They also set the millage rate for the Downtown Improvement Authority at 1.000 mills.

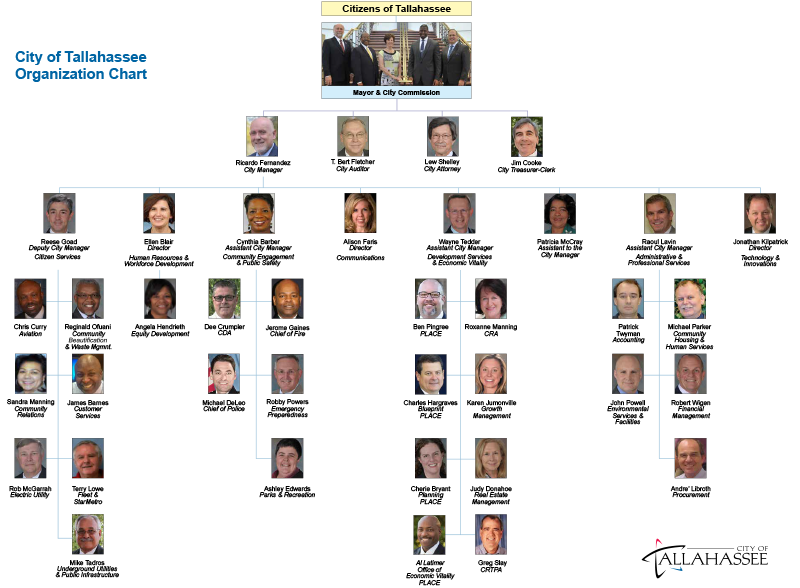

1.2 Organizational Chart

Return to Top

Download the Organizational Chart

Download the Organizational Chart

1.3 Mission & Values

Return to Top

The City of Tallahassee, through workshops, surveys and commission retreats has developed the following vision,

mission, and target issues. These are used as the basis for the performance measurement process that each

department has implemented. Over the coming year, the measures will be reviewed and evaluated to ensure they are

aligned with the City of Tallahassee’s vision, mission, values, critical success factors, and target issues.

Vision Statement

Tallahassee, Florida, a city that remembers its past

while focusing on the future –

a vibrant capital city: fostering a strong

sense of community, cherishing our beautiful natural environment, and ensuring economic opportunities for all our

citizens.

Mission

The mission of the City of Tallahassee is to provide excellent services and facilities to support a high quality of life for

our community.

Organizational Values

We adopt these organizational values as our guiding principles. We intend to hold each other accountable to support

and demonstrate these values in our daily actions and decisions.

- Customer service is our business

- Demonstrate leadership and personal responsibility

- Promote and support employee excellence

- Practice teamwork

Critical Success Factors

- Maintain financial stability and improve economic viability

- Provide quality services responsive to customers

- Enhance community and neighborhood vitality

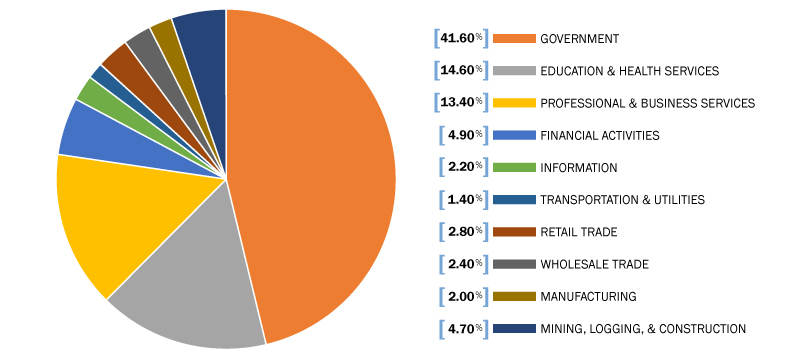

1.4 Employment by Sector within Tallahassee

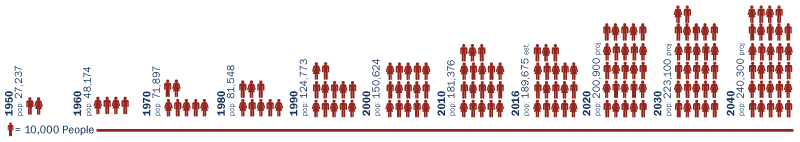

1.5 Population

1.6 Interesting Tallahassee Facts

Return to Top

- A median age of 26.2 ranks Tallahassee as the second youngest city in Florida.

- Minorities account for 43% of the City’s population (35% African American) as compared to the state level of 24% minorities (16% African American).

- The city owns and operates six utilities: an electric generation, transmission, and distribution system, a natural gas distribution system, a water production and distribution system, a sewage collection system, a solid waste and recycling collections system and a storm water/flood control facility.

- In addition, other enterprise activities owned and operated by the City of Tallahassee include fire services, a regional airport, public transportation, cemetery, and a municipal golf course. The City owns and operates an additional non-enterprise golf course that is funded by the general fund.

- The city is home to two state universities and a community college. Combined, public sector employment accounts for about 36% of the Tallahassee Metropolitan Statistical Area labor force and helps to keep unemployment rates below the state and national levels.

1.7 Property Tax Per $1,000

Return to Top

WHAT IS A MILLAGE RATE?

The millage rate (also known as property tax) is the amount per $1,000 used to calculate taxes on property. Millage rates are most often found in personal property taxes, where the expressed millage rate is multiplied by the total taxable value of the property to arrive at the property taxes due.

TALLAHASSEE

4.1000

FT.LAUDERDALE

4.1193

GAINESVILLE

4.5079

LAKELAND

5.5644

WEST PALM BEACH

8.3465

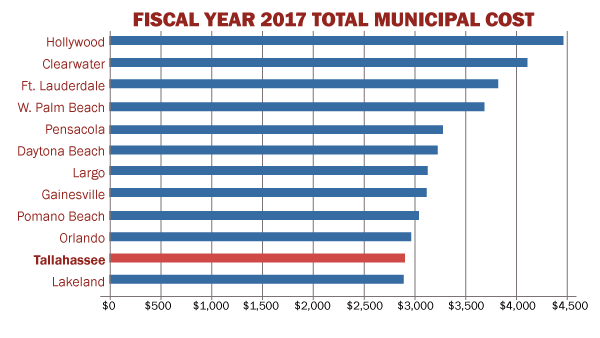

1.8 Municipal Cost Comparison

When compared to eleven other Florida cities Tallahasseans pay less than average for municipal services. Strong leadership from our City Commission combined with dedicated, customer focused City employees provides for quality services delivered at a reasonable cost.

The Municipal Cost Comparison below shows the cost of service and the financial impact of municipal services to citizens. This Comparison tabulates the full slate of public services a typical household would pay each year. The comprehensive comparison includes seven categories representing Property Taxes, Utilities (Water, Sewer, Electric), Solid Waste, Storm Water, and Fire Service. It is based on the average home value by city, average utility usage, and the annual cost of storm water and fire fees.

Overall, the comparison shows that the cost of the services is the second lowest in the State. This is good news for us as service providers and for everyone living in Tallahassee. Even with the second largest area to serve and second largest population, the City of Tallahassee has the second-lowest total municipal cost to its citizens, averaging $2,859 per year!

View the data behind the Municipal Cost Comparison

2.1 Fiscal Year 2017 Budget Calendar

- October 1, 2015 - Fiscal Year 2016 Begins

- January 27, 2016 - First Quarter Budget Update

- March 23, 2016 - Peer Review Recommendations

- April 13, 2016 - Budget Plan Workshop

- April 27, 2016 - Second Quarter Budget Update

- May 11, 2016 - Budget Plan Workshop

- June 1, 2016 - Preliminary Estimate of Taxable Values

- June 20, 2016 - Budget Plan Workshop

- July 13, 2016 - Third Quarter Budget Update

- July 13, 2016 - Budget Plan Workshop

- July 13, 2016 - City Commission Sets Tentative Millage Rate

- September 14, 2016 - First Public Hearing on Millage Rate and Budget

- September 24, 2016 - Budget Notice Published

- September 28, 2016 - Final Budget Hearing on Millage Rate and Budget

- October 1, 2016 - Fiscal Year 2017 Begins

2.2 Fiscal Year 2017 Budget Process

View Full FY17 Budget Process Document

The budget process is a formalized occurrence that involves collaboration and coordination among the respective city departments, Financial Management, the City Manager, the executive team, the City Commission, and the citizens of Tallahassee. The process results in annual operating and capital budgets and a five-year financial and capital improvement plan for the General Fund and Enterprise Funds.

The public is encouraged to provide input anytime of the year using various methods, such as City Commission meetings, City Commission budget workshops and resident surveys. Two statutorily required public hearings on the budget are also held in September each year to solicit public input.

For FY17, City leadership identified transparency as a top priority in the budget process. To that end, Florida local government professionals in the field of budgeting and open government were invited to conduct a peer review of the City’s budget process. The objectives of the review were to provide recommendations related to the budget process, community engagement in the process and increased transparency of the budget process. The recommendations led to a number of improvements, including the City’s use of OpenGov, an online financial transparency tool.

Departments are responsible for developing their respective budget requests with support from Financial Management.

Throughout the year, City Commission budget workshops are held to discuss policy issues and long term ramifications of budgetary decisions. The City Commission adopts a tentative millage rate for the assessment of ad valorem taxes in early July as required by state statutes. The final budget and the millage rate are adopted by resolution during the month of September, following two statutorily required public hearings.

The FY17 budget plan was developed with a “hold the line” directive from the City Manager for all General Fund departments, StarMetro, and Internal Service Funds. Approved personnel cost increases, with the exception of those defined by collective bargaining agreements, are to be absorbed by the department over the course of the fiscal year through operational efficiencies. The City’s enterprise operations developed budget plans based on revenue estimates consistent with the most recent rates studies.

Budgetary control is maintained at the department level, with Financial Management providing support to departments in the administration of their budgets. In accordance with the city’s budget transfer policy, departmental budgets can be amended in various ways depending on the type of transfer being considered.

Any budgetary amendment that is within the department’s appropriated budget and within the same fund can be authorized by the City Manager. Transfers between departments that cross funds or increase appropriations are made at the request of the City Manager and must be approved by the City Commission.

Budgetary amendments between divisions and within the same fund within a department may be initiated at the discretion of the department head except for transfers affecting personnel services, allocated accounts, accounts for insurance, bad debt, taxes or grants, articles for resale, fuel accounts, debt service, or interfund transfers. Requests for amendments to the line item exceptions are reviewed by Financial Management and approved by the City Manager or respective appointed official for transfers affecting the offices of the City Attorney, City Auditor, or City Treasurer-Clerk.

Since the implementation of the PeopleSoft financial system, budgetary control has moved from the line item level to major budget category. With the exception of the line items identified above, departments may over-expend line items provided there are available balances in the respective major budget category.

Currently, the budgets for general government operations (General, StarMetro and Golf Course Funds) are prepared on a modified accrual basis. This means that obligations of the city (i.e., outstanding purchase orders) are accounted for as expenditures, but revenues are recognized only when they are measurable and available. At year end, open encumbrances are reported as reservations of fund balance. The operating budget does not include expenses for depreciation.

The budgets for the city’s utilities (Electric and Underground) and other enterprise operations (Aviation, Building Inspection, Solid Waste, Fire, and Cemeteries) are budgeted on a full accrual basis. Not only are expenditures recognized when a commitment is made (e.g., through a purchase order) but revenues are also recognized when they are obligated to the city (i.e., water user fees are recognized as revenue when bills are produced).

Budget and accounting procedures are subject to modifications to comply with GASB 34.

2.3 Finance Policy Summary

Return to Top

The City regulates the planning, management, and financing of general government and enterprise operations through established policy standards. These policies define the appropriate use of year-end surpluses, transfers to general government operations, and establish operating reserves for select funds. Additional reserves such as the deficiencies, fleet, and RR&I reserves are also governed by the City’s finance policies.

View full Finance Policy Summary

General Government: aggregate revenues or expenditures in the General Fund plus transfers to StarMetro, CRTPA, and Golf Course funds, when required.

Surplus

Any remaining balance is first used to fund the Deficiencies Reserve until the target level is achieved. After fully funding the deficiencies fund, any remaining balance may be used to support the subsequent year’s operating budget, up to a maximum of 5% of general government operating expenditures, and to buy down debt-financed capital improvement projects.

General Fund Transfer

$5.0 million in new funding is budgeted to support projects in FY17; less than $1 million has been programmed from the Undesignated Balance for FY17 projects.

Operating Reserve

Up to 5% of year-end surpluses will be allocated to support subsequent year’s operating deficit.

Other

Fleet Reserve:

The FY17 contribution is $1.37 million.

RR&I:

Undesignated balance set at a maximum of 3% of general government capital projects.

Surplus

Retained for fire operating and capital costs.

General Fund Transfer

No Transfer.

Operating Reserve

No Reserve.

Other

Not Applicable.

Surplus

Designated to fully fund the operating reserve and thereafter to fund gas system capital projects.

General Fund Transfer

The transfer policy was changed in FY12 to 6.99% of a 3-year average of system revenues. The transfer is now based on CPI. The transfer for FY17 is $2.8 million.

Operating Reserve

Funded at 25% of the previous year’s General Fund transfer. Used to meet General Fund transfer, if required.

Other

RR&I:

Transfer budgeted at a level equivalent to depreciation expense as provided in the applicable rate study.

Surplus

Except for the Information Systems Services Fund, revenues for all funds are balanced against actual expenditures, resulting in zero surpluses.

General Fund Transfer

Not applicable. Excess balances from budgeted revenues are transferred to the original funding source at year-end.

Operating Reserve

No Reserve.

Other

Funding needed for large capital outlays in the Information Systems Services Fund may be accumulated over a period of time in its RR&I fund.

Surplus

Operating fund balance after General Fund transfer minus bond reserves used to fully fund the operating reserve, with the balance designated for electric system capital projects.

General Fund Transfer

Starting in FY13 the transfer was fixed at $23.9 million and increased annually by CPI. The transfer for FY17 totals $29.1 million.

Operating Reserve

The operating reserve is comprised of four subcomponents, with the primary purpose aimed at providing working capital. The working capital component is targeted with having a balance of 60 to 90 days of operating expenses. The other three components are fuel risk management, emergency reserve and rate stabilization.

Other

RR&I:

Transfer budgeted at a level equivalent to depreciation expense as provided in the Comprehensive Annual Financial Report (CAFR). Bond covenants for 1998 Energy System bonds require a transfer to RR&I but do not specify an amount.

Surplus

Designated to fully fund the operating reserve and thereafter to fund water system capital projects.

General Fund Transfer

Starting in FY12, the transfer is budgeted at 6.99% of a 3-year average of system revenues. The transfer for FY17 is $3.4 million.

Operating Reserve

Funded at 25% of the previous year’s General Fund transfer. Used to meet General Fund transfer, if required.

Other

RR&I:

Transfer budgeted at a level equivalent to depreciation expense as provided in the Comprehensive Annual Financial Report (CAFR).

Surplus

Retained for cemetery operating and capital costs.

General Fund Transfer

No Transfer.

Operating Reserve

No Reserve.

Other

Not Applicable.

Surplus

Designated to fully fund the operating reserve and thereafter to fund sewer system capital projects.

General Fund Transfer

Starting in FY12, the transfer is budgeted at 6.99% of a 3-year average of system revenues. The FY17 transfer is $4.7 million.

Operating Reserve

Funded at 25% of the prior year’s General Fund. Used to meet General Fund transfer, if required.

Other

RR&I:

Transfer budgeted at a level equivalent to depreciation expense as provided in the Comprehensive Annual Financial Report (CAFR).

Surplus

Retained for stormwater system capital projects.

General Fund Transfer

The transfer to the General Fund represents administrative cost sharing only.

Operating Reserve

No Reserve.

Other

RR&I:

Maximum of 5% of capital projects funding sources, with a minimum level of 3%.

Surplus

Retained within fund and allocated according to airline use agreement.

General Fund Transfer

No transfer to General Fund. Full recovery of cost.

Operating Reserve

Minimum of 1/12th of operating and maintenance budget for Airport (less fuel for resale) designated for unanticipated non-recurring expenditures.

Other

RR&I:

Not applicable.

Surplus

Retained for rate stabilization reserve.

General Fund Transfer

Starting in FY12, the transfer is budgeted at 6.99% of a 3-year average of system revenues. The FY17 transfer is $1.8 million.

Operating Reserve

No Reserve.

Other

RR&I:

Not applicable.

2.4 Budget Statutes and Guidelines

Return to Top

There are a number of statutory requirements, internal policies, and other provisions that direct the development of the budget and its implementation throughout the year.

View full Statutes and Guidelines - FY17

Florida Statutes, Chapter 166 – This statute authorizes municipalities to levy taxes, issue licenses, and set user fees to raise money necessary to conduct municipal government activities. This chapter also requires that local governments adopt a balanced budget. The tentative balanced budget must be posted on the municipality’s official website at least 2 days before the budget hearing, held pursuant to s. 200.065 or other law, to consider such budget. The final adopted balanced budget must be posted on the municipality’s official website within 30 days after adoption.

Florida Statutes, Chapter 200 – This statute establishes procedures for adoption of local government annual budgets and limits ad valorem taxes to 10 mills. This statute also requires that local governments appropriate a balanced budget in which anticipated revenues and expenses are equal. Failure to comply with the provisions of the statute could result in loss of state revenue sharing and/or ad valorem taxes.

Ad Valorem Taxes – The Property Appraiser provides an annual estimate of taxable property values for the preceding year. Based upon adopted millage rates, municipalities are required to budget 95% of the gross taxable value for operating purposes. The city typically budgets 97%. In FY 2004, the city’s millage rate increased from 3.2 mills to 3.7 mills. This was the first millage rate increase since FY 1991. As a result of property tax reform legislation enacted by the Florida Legislature, the millage rate in the FY 2008 approved budget was reduced to 3.1686 mills. Due to the passage of Amendment 1 on January 29, 2008, the city’s millage rate for FY 2009 was 3.2115 mills. In FY 2010, the City Commission voted to increase the millage rate to 3.7 mills. The FY 2016 approved budget included a millage increase from 3.7 mills to 4.2 mills. For FY17, the millage was reduced to 4.1 mills.

Florida Statutes, Chapter 202 – The Communication Services Tax consolidates a variety of taxes formerly imposed on telecommunication, cable, home satellite and related services. Opting for the highest rate allowable by law, 6.1%, the City of Tallahassee is required to forego permit fee charges for use of city right-of-way.

Community Redevelopment Agency, Florida Statutes Chapter 163, City of Tallahassee Ordinance 00-O-51 and 04-O-60 To encourage economic development, the City Commission established a Community Redevelopment Agency (CRA) and designated an initial district (Frenchtown) of approximately 1,400 acres for redevelopment. A second district (Downtown) was approved in June 2004. Each CRA district is entitled to 95% of the ad valorem tax increment generated within the district and the proceeds may be used only for improvements in the district.

Downtown Improvement Authority, Florida Statutes Chapter 71-935 – Established by a special act in 1971, the Downtown Improvement Authority may levy an additional ad valorem tax, not to exceed one mill, on properties within the district. Proceeds are used for improvements in the district and are administered by a separate Board of Directors.

Comprehensive Plan – The Tallahassee-Leon County 2010 Comprehensive Plan was originally adopted by ordinance in FY 1990 and is updated with biannual amendment cycles. The Plan includes capital improvements, transportation, historic preservation, utilities, recreation, and other elements which provide a framework for allocating budget resources. The Capital Projects Summary includes a listing of capital projects that address Comprehensive Plan initiatives by eliminating deficit levels of services or by maintaining existing levels of service.

Financing Policy, No. 224 Commission Policies – The financing policy establishes guidelines for distribution of year-end surpluses, transfers from the utilities to the General Fund, types and amounts of operating reserves, and funding for capital projects from undesignated fund balance year-end revenues. The policy also provides for full recovery of cost for enterprise funds, limits non-utility fee increases to a maximum of 20% per year unless otherwise approved by the City Commission; and allows discount fees for recreational programs for youth, seniors, and disabled citizens. The “Finance Policy Summary” chart shows the requirements of the policy as applied to each fund.

Risk Management Policy/Self-Insurance, No. 214 Commission Policies – This policy creates an internal service fund for payment of anticipated claims and judgments for coverage areas defined in the policy. In addition, a special Insurance Reserve Fund is established and funded to meet unanticipated losses from catastrophic events or claims in excess of the Risk Management Fund. This reserve is set at 150% of the average claims for the past five years or $3,000,000, whichever is greater.

Capital Project Management, No. 218 Commission Policies – This policy provides for preparation of an annual capital budget and for a five-year capital improvement plan. The policy also defines roles and responsibilities of city departments and management regarding contracts, supplemental appropriations, over expenditures, and project administration. The use of capital project overhead charges as an operating budget funding source also is established by this policy.

Local Option Sales Tax Management, No. 232 Commission Policies – This policy establishes the authority to provide advance funding for local Florida Department of Transportation (FDOT) projects for any project or phase of project included in the FDOT five-year work plan. It allows for advance funding without an agreement for repayment after conducting a public hearing. The policy also authorizes the use of short-term debt to cover cash flow shortages that may result from this practice.

Debt Management Policy, No. 238 Commission Policies – The debt management policy, along with an analysis of the city’s compliance with the policy, is included in the capital budget summary and in the capital improvement plan. Section 104 of the City Charter also specifies that general obligation debt will not exceed 20% of the assessed taxable valuation. Florida Statutes require that general obligation bonds be approved by referendum. The city currently does not have any general obligation bonds.

Vehicle Replacement Reserves – Funding for replacement of vehicles is included on an annual basis in the capital budget. To fund the reserves, each department is charged in the operating budget for a proportionate share of these costs based on equipment usage.

Bond Covenants – Prior to 1998, provisions of Bond Resolutions required that a minimum of 5% of prior year gross revenues be budgeted annually for Renewals, Replacements, and Improvements (RR&I) for system improvements in the utility enterprises. Covenants for the Energy System (electric and gas) bonds that were issued after 1998 do not specify an explicit amount or methodology but require a transfer to an RR&I fund.

Union Agreements – Currently, unions represent 668 FTEs (authorized positions). A total of 385 positions are subject to terms and conditions of the collective bargaining agreement with the Big Bend Chapter of the Florida Police Benevolent Association, Inc. and 283 positions are subject to terms and conditions of the collective bargaining agreement with the International Association of Firefighters (IAFF). The City Commission and police officers re-opened a new agreement, which was resolved April, 2015. The agreement was retroactively commenced on October 1, 2014 and extended through September 30, 2017. The IAFF ratified a new agreement on collective bargaining contracts for the existing firefighter unit (firefighters, fire engineers, and fire lieutenants) and the supervisory unit (battalion chiefs and captains) on January 8, 2015 and the City Commission approved it on January 14, 2015. The agreement was retroactively commenced on October 1, 2014 and extended through September 30, 2017.

Utility Rate Studies – Rate studies are prepared for each of the utility enterprise operations (electric and underground utilities). Revenue projections are prepared using historical weather patterns as well as other growth factors. These studies comprise the basis for the annual budgets for each of the utilities. Starting in October 2012, Water, and Sewer Utility rates increase annually by the CPI. This CPI increase methodology is the same for Electric, Natural Gas and Solid Waste rates. In January of 2016, electric, natural gas and solid waste rates were reduced for all customers. In October of 2016, electric and natural gas rates were reduced further and remain below the state average.

Assessment and Fee Reviews – Fees and assessments are periodically reviewed to ensure recovery of costs to provide certain services. A cost of services study for the animal shelter was conducted in 2006, which recommended a plan to recover at least 50% of the operating costs through animal licensing fees, but this has not been implemented. The City Commission also increased building inspection fees in August 2009 to fully recover all eligible building inspection costs. Rates for electric, underground utilities and solid waste are set by ordinances which provide for annual increase based on the CPI. Updated Fire services fee were implemented on October 1, 2015.

In January 2016, the City Manager implemented a re-organization plan that eliminated 10 positions, none of which impacted Community Engagement and Public Safety. The City’s total workforce reduced from 2,874.50 to 2,864.50 full-time equivalents (FTE’s). Over the last year, the City has increased the number of positions in Public Safety in order to address significant needs for community services. To meet the priorities of the City Commission, departments were reorganized to increase efficiency and effectiveness. Service areas have been redefined and divisions consolidated based on similar functions resulting in less redundancy while augmenting planning and coordination. Leading to areas requiring internal and external service reporting directly to the City Manager divisions were merged so that we can better serve our citizens.

As such, general funded departments committed to meeting the fiscal year 2016 budget plan with, the FY16 general fund budget being the FY17 target for general fund operations. As management efforts are accomplished and savings are realized, budget plans were discussed for areas that require a higher priority of funding (ex. public infrastructure capital projects). The City is streamlining resources to enhance and improve the effectiveness of all operations. In January 2016, divisions within Public Works were merged into other departments to align similar functions to better serve citizens. In the FY 2017 budget plan, specific Public Infrastructure (PI) divisions were transferred from the general fund into the respective enterprise fund in order to immediately reduce the amount of administrative effort spent calculating and reconciling internal billing of project work between the General Fund and these enterprise funds. These position, operating savings, and subsequent adjustments for staffing assignments in the re-organization are reflected in the FY16 and FY17 budget. As departments continue to re-assess the organization needs, additional savings and adjustments in operations are expected. These changes reflect the ongoing effort to provide and support critical services, and to streamline the organization to both mission-effective as well as cost-effective simultaneously.

3.1 Position Summary

View full FY17 Approved Position Summary

|

Department

|

FY 2016 Adopted FTE's

|

FY17 Approved FTE's

|

Net Change (FY16 vs. FY17)

|

|

City Commission/Office of the Mayor

|

13.00

|

13.00

|

0.00

|

|

City Attorney

|

21.00

|

21.00

|

0.00

|

|

Treasurer-Clerk

|

56.50

|

56.50

|

0.00

|

|

Auditing

|

7.00

|

7.00

|

0.00

|

|

Executive Services (Closed)

|

36.00

|

0.00

|

(36.00)

|

|

Executive Services (New)

|

0.00

|

25.00

|

25.00

|

|

Technology and Innovations (New)

|

0.00

|

99.50

|

99.50

|

|

Human Resources & Workforce Development (New)

|

0.00

|

35.00

|

35.00

|

|

Fire

|

296.00

|

297.00

|

1.00

|

|

Police

|

466.00

|

466.00

|

0.00

|

|

Public Works (Closed)

|

286.00

|

0.00

|

(286.00)

|

|

Parks, Recreation and Neighborhood Affairs

|

173.25

|

173.25

|

0.00

|

|

Planning

|

26.00

|

27.00

|

1.00

|

|

Community Housing and Human Services (FKA Economic & Community Development)

|

36.00

|

20.00

|

(16.00)

|

|

Aviation

|

55.00

|

55.00

|

0.00

|

|

StarMetro

|

148.00

|

141.00

|

(7.00)

|

|

Electric Utility

|

303.00

|

336.00

|

33.00

|

|

Growth Management

|

62.00

|

80.00

|

17.00

|

|

Community Beautification & Waste Mgmt (FKA Solid Waste)

|

83.00

|

148.00

|

65.00

|

|

Real Estate Management (New)

|

0.00

|

11.00

|

11.00

|

|

Customer Services (FKA Utility Services)

|

148.00

|

135.00

|

(13.00)

|

|

Communications

|

14.00

|

8.00

|

(6.00)

|

|

Community Relations (FKA Customer Services)

|

1.00

|

17.00

|

16.00

|

|

Administration & Professional Services (FKA Management & Administration)

|

184.00

|

61.50

|

(122.50)

|

|

Fleet Management

|

80.00

|

82.00

|

2.00

|

|

Underground Utilities & Public Infrastructure (FKA Underground Utilities)

|

362.00

|

531.00

|

169.00

|

|

Emergency Preparedness & Facilities Security (FKA Emergency Management)

|

1.00

|

5.00

|

4.00

|

|

Environmental Services & Facilities Management (FKA Environ. Policy & Energy Resources)

|

14.00

|

12.00

|

(2.00)

|

|

Ethics Office

|

1.75

|

1.75

|

0.00

|

|

Total

|

2,874.50

|

2,864.50

|

(10.00)

|

Eliminated Positions

The following ten (10) positions were eliminated as a part of the FY16 reorganization implemented in January 2016:

- Administrative Service Manager (Public Works)

- Director-Public Works (Public Works)

- Manager-Public Works Operations (Public Works)

- Asst. Dir-Economic & Community Development (Economic and Community Development)

- Superintendent-Transit Maintenance (StarMetro)

- Transportation Finance Administrator (StarMetro)

- Administrative Supervisor (Utility Services)

- General Manager-Utility Services (Utility Services)

- Dir-Environ Policy & Energy Resources (Environmental Policy & Energy Services)

- Administrative Services Manager (Environmental Policy & Energy Services)

3.2 City Departments

The City of Tallahassee is comprised of 27 departments.

Download all Department Descriptions

City Commission/Office of the Mayor

The Mayor and City Commission serve as the governing body of the City; they set policies and rules by which the City is operated, including establishing City goals and target issues, as well as setting City tax rates.

City Attorney

The City Attorney's Office provides legal counsel and representation to the Tallahassee City Commission, City Manager, city departments, and city-appointed boards and commissions in any suit, action or proceeding filed by or against them.

Treasurer-Clerk

The mission of the Treasurer-Clerk’s Office consists of the following: through the development and application of sound financial management practices and policies, to place the City in the most advantageous and secure financial position possible; through well formulated and administered benefit design to provide City employees with the availability of sufficient and secure retirement; and, to provide city government and the residents of Tallahassee with quick and accurate access to all City records and actions.

Auditing

The mission of the Office is to provide the City Commission an independent, objective, and comprehensive auditing program of City operations; advance accountability through the provision of assurance and advisory services; and actively work with Appointed Officials in identifying risks, evaluating controls, and making recommendations that promote economical, efficient, and effective delivery of City services.

Executive Services

The Executive Services Department includes the City Manager's Office consisting of the City Manager, four Assistant City Managers and the Assistant to the City Manager. Each Assistant City Manager is responsible for several departments that have been aligned to compliment to the FY16 city-wide re-organization as follows: citizen services, community engagement and public safety, development services and economic vitality, and administration and professional services. This department is also responsible for maintenance and repairs of City Hall.

Technology and Innovation

Technology and Innovation (T&I) is responsible for innovating and providing computer, telecommunications and radio services for all city departments. The focus is only to provide city departments with the ability to more efficient and effective through the use of technology, but to provide citizen’s access to services and city information through the use of technology as well. Revenues are derived through the distribution of costs to user departments. The department now reports directly to the City Manager as a part of the FY16 re-organization.

Human Resources and Workforce Development

The Human Resources & Workforce Development Department is responsible for the development, implementation and administration of all systems, programs, policies and procedures, as well as managing and coordinating organizational initiatives that impact City employees.

Fire

The Tallahassee Fire Department (TFD) is charged with the responsibility of protecting lives, property, and the environment from hazardous conditions that threaten our community. This mission is accomplished through the provision of prevention and protective services specific to the incident need.

Police

Having maintained its accredited status for three decades, the Department strives every day to fulfill its mission statement: To continue the time-honored tradition of excellence in public service by protecting and enhancing the quality of life for our citizens.

Parks, Recreation and Neighborhood Affairs

The Parks, Recreation and Neighborhood Affairs Department provides recreational opportunities for the citizens of Tallahassee and Leon County, liaison assistance for neighborhood associations and operates the Animal Service Center.

PLACE (Planning, Land Management and Community Development)

The PLACE/Planning Department provides leadership to facilitate high quality growth and development in both the City of Tallahassee and Leon County.

Community Housing and Human Services

The City’s Community Housing and Human Services Department provides services to the Tallahassee community through community housing, human services, and historic property preservation programs.

Aviation

The Aviation Department operates the Tallahassee International Airport. The Aviation Department consists of six divisions: the Executive Division; Commercial Development Division; Finance and Administration Division; Facilities Management Division; Operations Division and Capital Programs Administration Division.

StarMetro

StarMetro, the transit system, for the City of Tallahassee, operates 12 weekday cross-town routes, as well as university routes for Florida State University (FSU) and Florida Agricultural & Mechanical University (FAMU). StarMetro also provides demand response (para-transit) transportation to senior, disabled and low-income customers in Tallahassee and Leon County.

Electric Utility

The Electric Utility serves over 116,000 customers in a 221 square mile service territory. It is the fourth largest municipality utility in Florida, and is the 25th largest of over 2,000 municipal systems in the United States. The utility is comprised of seven major divisions: Administration, Power Engineering, Power Production, System Compliance, System Integrated Planning, System Reliability and Transmission Services, and Transmission and Distribution.

Growth Management

The Growth Management Department facilitates well-designed, efficient, healthy, and safely built developments, while ensuring preservation of the natural and cultural environment. The Department promotes economic vitality and environmental sensitivity through coordinated plan review, permitting and inspection services.

Community Beautification and Waste Management

Community Beautification and Waste Management Services provides garbage, trash, and recycling services to 67,500 customers, 60,800 residential and 6,700 commercial. In addition, the department is responsible for maintaining 13,500 acres of medians and rights-of-ways along major roadways within the City.

Real Estate Management

Real Estate Management provides comprehensive real-estate services for all city departments and is responsible for the acquisition of all real estate for capital improvement projects such as roads, stormwater facilities, utilities such as electric, gas, water and sewer, management of City-owned parking facilities, Renaissance and Gemini office buildings as well as the management and disposition of surplus property, leases and maintenance of the City’s real estate inventory.

Customer Services

The Customer Services division provides utility services administration, utility customer field operations, wholesale energy services and golf programs.

Communications

The Communications Department serves to keep the public informed of City policies and actions. This department directs media relations, public information and engagement programs, digital communications including the city’s website and social media and marketing programs, emergency response and community preparation communications efforts, and promotion of City initiatives and services.

Community Relations

The Office of Community Relations provides community engagement and outreach to the citizens of Tallahassee. This is accomplished through public awareness about a variety of topics ranging from energy conservation to innovative programs and sustainability. OCR partners with neighborhood leaders, churches, civic groups, and other organizations to improve the quality of life for all Tallahasseans.

Administration and Professional Services

This department’s responsibilities include development and preparation of the annual operating and capital budgets and related financial policies, enacting operational functions, financial reporting, grant writing, organizing centralized procurement activities, promoting community outreach, regulating green city initiatives, and ensuring City facilities and operations achieve and maintain compliance with all new, proposed and existing federal, state and local environmental laws, rules, and regulations.

Fleet Management

Fleet Management facilitates the acquisition, disposal, maintenance, repair, fuel consumption needs, and historical data collection for all the city’s vehicles and construction equipment with the exception of StarMetro buses. The Fleet program is comprised of five divisions: administration, service, parts, motor pool, and garage unit.

Underground Utilities and Public Infrastructure

The Underground Utilities and Public Infrastructure provide the following services: public infrastructure, gas, water, sewer and stormwater management.

Emergency Preparedness and Facilities Security

The Emergency Preparedness and Facilities Security Department plans and prepares for disasters affecting Tallahassee and surrounding communities.

Environmental Services and Facilities Management

The core mission of the ERC Division is to ensure that City facilities and operations achieve and maintain legal compliance with all federal, state and local environmental laws, rules, regulations and ordinances.

Ethics Office

The Ethics Board and independent Ethics Office maintain the integrity of city government and functions.

3.3 FY17 Funding for Outside Agencies

Return to Top

Throughout the annual budget process, non-profit organizations are afforded the opportunity to request donation funding from the general fund by submitting written requests. The City Commission makes the final decision on the amount and appropriation of funding for each organization. Pass-through grants from other agencies are excluded from this list.

View FY17 Funding for Outside Agencies

4.1 Capital Budget Process

The capital budget and five-year capital improvement plan (CIP) support construction-related projects and major automation enhancements, which improve the city’s infrastructure and information technology capabilities. As with the operating budget, the capital budget is developed within the framework provided by the city’s five-year financial plan and targets and goals established by the City Commission.

Typically, departments update the five-year CIP by moving out-years forward and adding a fifth year. In some cases, projects are fast-tracked or deferred based on new priorities, availability of funds, etc. Also, the departments, with the exception of the Electric Utility and the Gas section of Underground Utilities, review all projects for the achievement of goals and objectives set forth in the comprehensive plan and for compatibility with the BluePrint 2000 Plan.

After budget instructions are developed and sent to departments, departmental capital budget requests are submitted to Financial Management. Recommendations are made based upon the departments’ priority listing and the level of funds available. This information is presented to the City Commission for consideration. The process for public input and adoption of the capital budget is concurrent with timelines discussed in the operating budget process section. Throughout the fiscal year, Financial Management monitors the capital improvement plan and provides semi-annual status reports to the City Commission.

4.2 FY17 Department Capital Projects and Descriptions

Air Cargo Facility Expansion

This project will fund periodic inspections, preventative maintenance activities, major/minor repairs performed during outages, and replacements and improvements to the generating units and balance of plant (BOP), including, but not limited to, structures, spillway and earthwork, at the C.H. Corn Hydroelectric Generating Station to ensure compliance with all federal, state and local regulations and the safe, reliable and efficient long-term operation of the generating units.

This master project includes, but is not limited to, FERC required activities, roof coating and a turbine generator inspection. Additional unanticipated or unspecified plant repairs or improvements of higher priority can be substituted for the projects on the list and/or be funded from the master project and there is no limitation of the amount a subproject can be set up from the master.

This is a recurring project. Annual appropriations to the master projects that are not utilized to fund specific projects prior to the end of the fiscal year will be returned to the fund balance.

Future Funding

Air Carrier Apron Improvements

This project is to incorporate improvements to the air carrier apron (pavement, drainage and lighting) and will include expansion of the air carrier apron in order to expand the terminal building and to increase the number of gates and apron parking positions.

Future Funding

Air Service Development

This project is to incorporate improvements to the air carrier apron (pavement, drainage and lighting) and will include expansion of the air carrier apron in order to expand the terminal building and to increase the number of gates and apron parking positions.

FY2017 Budget: $1,000,000

Air Service Improvement Program

This is a project to improve airline service at Tallahassee Regional Airport that encompasses the market segment analysis, other studies, air service workshops, and direct contact that identifies air service opportunities that may result in formal and/or informal air service proposals and the provision of incentives for new service or needed competition to a key market as identified by the Airport Air Service Consultant that can consist of up to $300,000 of marketing/operational assistance, and/or rebate or waiver for selected airline rates and charges for up to 2 years.

FY2017 Budget: $600,000

Air Traffic Control Tower Repairs

The air traffic control tower (ATCT) at Tallahassee Regional Airport was completed in 1996. Routine maintenance and repair work is needed in order to provide a suitable working environment.

FY2017 Budget: $80,000

Aircraft Maintenance and Storage Hangar and Related Taxi Lanes

Master Plan Project - The airport needs additional storage hangars for privately owned aircraft. This project will provide for site preparation and construction of taxi lanes to support future development of hangars under a private-public partnership.

Future Funding

Airfield Lighting Improvements

Relamping of both runways and all taxiways with LED lights. This project includes changing signage locations to improve traffic flow and safety and ensuring all signs meet current FAA Standards.

Future Funding

Airfield Maintenance Sweeper T

This project will provide for the purchase of an airfield maintenance sweeper truck as specified in the FAA Advisory Circular 150/5210-24 for the removal of Foreign Object Debris (FOD) on runways, taxiways and other movement areas on the airfield, and as part of the Airports FOD removal management program.

Future Funding

Airfield Preservation - Phase II

This project is to perform necessary rehabilitation and improvements to airport pavements (runway, taxiway, and apron), associated grounds, markings, lighting, and signage, and other work to provide for short term improvements necessary to keep the airfield in compliance with standards.

FY2017 Budget: $200,000

Airport Access Roadway Realign

This project will provide for the realignment of primary airport roads that enable access to the Commercial Airline Terminal, Fixed Base Operator (FBO) Facility, and Air Cargo Facility from adjacent State Road 263.

Future Funding

Airport Emergency Power Improvements

This project will provide for the design, engineering, construction and construction administration required for improvements to emergency generators and uninterruptable power supplies associated with the airfield, fuel farm, Aircraft Rescue and Fire Fighting (ARFF) Facility and Terminal Building.

Future Funding

Airport Funfest

The Tallahassee Regional Airport is dedicated to creating a visible presence in the surrounding communities through meaningful public involvement. Staying connected to the people living in the communities that we serve, through special events and charitable giving, is vitally important to maintaining this connection. Special events provide a unique opportunity for the airport to interact with key community stakeholders, reinforce its brand and engage local businesses in a day of celebration. This is a recurring project. Annual appropriations that are not expended by the end of the fiscal year will be returned to fund balance.

Future Funding

Airport Information Technology Analysis

This project will provide a needs assessment and report that reviews current information technology and city standards associated with airport information technology, fiber optics, cabling, data rooms, cyber security and other best practices within the airport environment necessary to meet current and future demand.

Future Funding

Airport Operations Center Renovations and Upgrades

This project will provide for the design, engineering, construction and construction administration required for improvements to the Airport Operations Center. In addition, this project will evaluate current space requirements and future needs associated with the Airport Communications Center, Airport Identification Badging Office and Training Room required to meet current and evolving FAA and TSA regulatory requirements.

Future Funding

Airport Safety Management System (SMS) Update

This project will provide the necessary updates to the current airport Safety Management System by developing, designing and implementing a program with support tools such as a computerized system which will incorporate both the Federal Aviation Administration’s (FAA) latest guidance as per Advisory Circular 150/5200-37 under USC 14 CFR Part FAR 139 as well as implementing the newest standards.

Future Funding

Airport Safety Project II

This project will provide for the required tree removal per federal and state regulations to improve safety conditions for aircraft and mitigate wildlife hazards.

FY2017 Budget: $50,000

Airport Security Improvements

This project is to provide for periodic rehabilitation, retrofit and upgrades to equipment and automated systems used for airport security, safety, access control and surveillance activities. The project will also address federal regulatory compliance requirements along with physical security upgrades.

FY2017 Budget: $325,000

ARFF Station Rehab

This project will rehabilitate the existing, 20 year old, ARFF station with upgrades and improvements to the structure and interior, truck bay, and other areas to ensure it is capable of housing the latest equipment and providing for training and housing of firefighters.

Future Funding

Bucket Truck

This project is required to replace our current bucket truck which has exceeded its surface life.

Future Funding

Business/Economic Development

This is a project is to provide for business and economic development at the Tallahassee Regional Airport that encompasses studies, development of marketing strategies and promotional materials including print and digital media and participating in events to advertise opportunities as the Airport.

FY2017 Budget: $25,000

Computer Based Training Upgrades

This project will provide an upgrade in equipment and programming that both staff and airport tenants / employees must use to complete training for work in secure areas. This also includes an update to all web-based learning management and course delivery systems.

Future Funding

Computerized Maintenance Management System (CMMS)

This project will provide the required hardware, software and programming necessary to request, assign and track work orders. The system will also provide management reports necessary to demonstrate proof of compliance for both preventive and corrective maintenance items required to maintain compliance with federal, state and local regulatory requirements.

Future Funding

Consolidated Rental Car Facilities

This project will provide for the design, engineering, construction and construction administration of a consolidated rental car and parking facility. This project will include at a minimum a two-bay car wash facility, 12,000-gallon above ground fueling facility with multi-dispensers and four two-sided vacuuming systems with independent storage cabinets to accommodate all rental car companies.

FY2017 Budget: $1,600,000

Emergency Maintenance

This project provides for the emergency repair of aging interior systems in the terminal building which must be dealt with in a time critical fashion and may include areas such as the HVAC systems, Plumbing, Electrical and Motorized Equipment.

FY2017 Budget: $30,000

Enhancements and Upgrades ATCT

The Air Traffic Control Tower at TLH was completed in 1996. A number of improvements and enhancements are needed to provide a suitable working environment. These include replacement, rehabilitation, and improvements to the roof structure, tower cab windows and interior flooring and furnishings.

Future Funding

Facilities Assessments

This project will provide for the assessment and prioritization of needed HVAC, Life Safety, Roof, Elevator, ADA Compliance and other required repairs and upgrades to airport facilities. Separate assessments will be conducted on the Air Traffic Control Tower, Terminal Building, Aircraft Rescue and Fire Fighting (ARFF) Station and Facilities Maintenance Buildings.

FY2017 Budget: $50,000

Facilities Building (Maintenance Complex)

This project involves scheduled and unscheduled improvements and maintenance for the Water Quality Facility. Among the recommendations proposed are additional building and roof repairs, parking lot improvements, mechanical system maintenance and repairs, and maintenance on the current security system. This is a recurring project. Annual appropriations that are not expended prior to the end of the fiscal year will be returned.

Future Funding

Hangar Development

The Airport Master Plan recommends additional hangars be constructed to meet forecast demand. The hangars, based on demand, will take the form of bulk, maintenance, corporate, T-hangars, and/or others, which will be funded by a combination of 2020 Sales Tax and Florida Department of Transportation funds. The project is anticipated as a two year project from Fiscal Years 2019-20.

Future Funding

Hangar(s) Development and Mode

The Airport Master Plan recommends additional hangars be constructed to meet forecast demand. The hangars, based on demand, will take the form of bulk, maintenance, corporate, T-hangars, and/or others, which will be funded by a combination of 2020 Sales Tax and Florida Department of Transportation funds. The project is anticipated as a two year project from Fiscal Years 2019-20.

Future Funding

International Port of Entry

The Electric Utility performs numerous projects at the request of citizens, businesses and organizations to repair damages to the electric system infrastructure, as well as for other specific services requested by electric customers. There are basically two types of requests: 1) specific work relative to electric facilities that are paid by the customer (e.g., pole relocation), and 2) emergency repairs necessary because of damages to electric system property that will be paid by the party responsible for the damage. The estimates are based on historical expenditures for these types of activities, and all expenditures are fully reimbursed by the requesting or responsible party. Incurred costs are billed by the utility through the city's billing and accounts receivables process.

The establishment of a International port of entry and foreign trade zone at Tallahassee Regional Airport is anticipated to facilitate economic development for the community by increasing international commerce through the airport. Establishment of a foreign trade zone requires a series of steps including development of a feasibility plan, involvement of the public and local businesses, inventory, and implementation of a marketing program. This project also could facilitate development of the airport business park, which is under consideration. This project is recommended for planning purposes contingent on the availability of funds.

Future Funding

Jet Bridge Rehabilitation

"Recurring project to provide for unanticipated repairs to Airport jet bridges. Annual appropriations not expended by the end of the fiscal year will be

returned to fund balance."

FY2017 Budget: $25,000

Marketing and Promotions Study - Phase II

To enhance offerings to customers, the Airport conducts various studies and promotions. This project will assist in attracting new and retaining current customers.

FY2017 Budget: $100,000

Miscellaneous Major/Minor Repair/Replacement/Improvements

Airport infrastructure often is in need of repair, replacement, or improvements. These types of small, immediate needs must be dealt with in a timely fashion and may include pavements, building structures, installed equipment, and/or grounds. Additionally, funding is needed for ad hoc projects that occur during the year (i.e. safety and security issues, studies, etc.). This project is a recurring project funded from Repair, Replacement and Improvement (RR&I) funds. Annual appropriations that are not expended prior to the end of the fiscal year will be returned to fund balance.

FY2017 Budget: $175,000

Parking Area Improvements

This project provides for the design, engineering, construction and construction administration for improvements to the parking facilities. This project includes the replacement of the revenue control system, entry and exit lane equipment, technology upgrades and other related improvements.

FY2017 Budget: $600,000

Perimeter Road Rehabilitation

TSA Part 1542 and FAA Part 139 required fencing of the airfield to protect it from intrusions. A perimeter road is required to inspect that fence on a more than daily basis in all weather conditions. This project will rehabilitate and improve the existing road that was originally constructed in 2005.

Future Funding

Rental Car Improvements

This project will provide for the maintenance, rehabilitation and repair of the rental car service area, terminal rental counters, offices and parking facilities.

FY2017 Budget: $75,000

Runway 18/36 Reconstruction

This provides for the design, engineering, construction and construction administration to improve the surface of runway 18/36. Rehabilitation of the runway surface is required to maintain a proper pavement surface for aircraft and to restore the useful life of the existing pavement.

Future Funding

Safety & Security System Repairs

For repairs to the Access Control, Badging and Video Surveillance System that will periodically become necessary due to various equipment failures that are expected to occur as a result of normal life cycle failures, severe weather, power surges etc. This is a recurring project. Annual appropriations that are not expended by the end of the fiscal year will be returned to fund balance.

FY2017 Budget: $60,000

Security Checkpoint Improvements

This project will incorporate the necessary facility and equipment changes required to ensure the highest levels of safety and security for our traveling public. This project will include the design, purchase, installation, and construction management necessary to incorporate required passenger screening, camera surveillance and exit lane technologies.

FY2017 Budget: $2,133,700

Security Fence and Gate Rehabilitation, Updates and Improvements

TSA Part 1542 requires the Airport Operating Area to be secure. FAA Part 139 requires the Airport to be secure from wildlife and other intrusions. To meet both of these requirements, the Airport installed over 50,000 linear feet of fencing and approximately 45 gates in 2005. This fence and gates are in need of rehabilitation and improvements to ensure its continued operation in accordance with both TSA and FAA regulations.

Future Funding

South Ramp Reconstruction

This project includes the design, engineering, bidding, construction and construction administration services required to provide for the reconstruction and rehabilitation of the south ramp. This public use ramp is critical for the smooth and efficient operations necessary to accommodate general aviation, military, business and charter aircraft.

FY2017 Budget: $500,000

Taxiway Improvements

This project is to provide a short-term rehabilitation of taxiway pavements and includes sealing cracks, seal coating, and other repairs as well as grading shoulders and stormwater ponds and associated landscaping.

Future Funding

Terminal Building Life Safety System Upgrades

This project provides for the design, engineering, construction and construction administration required to meet federal, state and local life-safety requirements. This project includes replacement of the existing fire alarm control panel and associated improvements required to ensure visual and audible notifications and life-safety egress.

FY2017 Budget: $1,911,400

Terminal Concessions Redevelop

This project provides matching funds for projects to assist the Airport’s primary concessionaire in renovation projects, including the mid-term refurbishment requirement, maintaining compatibility with the Airport’s terminal improvement projects and providing updated signage and flooring.

Future Funding

Terminal Modernization

This project provides for the design, engineering, construction and construction administration required to meet federal, state and local life-safety requirements. This project includes replacement of the existing fire alarm control panel and associated improvements required to ensure visual and audible notifications and life-safety egress.

FY2017 Budget: $1,650,000

Terminal PLB Acquisition and I

Passenger Boarding Bridges at Tallahassee Regional Airport will be 25 years old and in need of replacement. This project will replace six boarding bridges (A3, B3, B5, A5, A1 & A6).

FY2017 Budget: $1,400,000

Utility Infrastructure

This project will provide the utility infrastructure, such as electric, sewer, water, fiber optic cable, which is necessary to attract and retain new business to the parcels which have been identified within the airport strategic business plan.

Future Funding

Vehicle Replacement Upgrade-Airport Operations

This project provides funding for the aviation-specific equipment required to be installed on vehicles operating within the airport environment which are not covered by fleet vehicle replacement funding.

FY2017 Budget: $15,000

Commission Chambers Sound System/WCOT broadcast equipment

This project provides funding to upgrade WCOT's broadcast system and cameras in the Commission Chambers. Niche Video Products, Inc. provided the City with an assessment and project summary for a WCOT TV Facility Upgrade to HD. This project would be phased over multiple years.

Future Funding

Communications Equipment

Funding for WCOT broadcast and PIO Public Relations, Community Outreach and Web Development equipment purchases.

Future Funding

Green Building and Yard Improvements

Efficiency improvements to the two story “Green Building” and yard to maintain the Green Building Certification

FY2017 Budget: $100,000

Historic Property Preservation Grant and Loan Pool

This is a master project that provides funding for the City's Historic Preservation Grant and Loan (HPGL) Pool program. This program was established to provide grants and loans for the preservation and rehabilitation of designated historic properties. Grants and loans may be given for the stabilization or restoration of historic structures; structural repairs, facade restoration, or rehabilitation; compliance with code, health and safety requirements; and other construction activity that will result in a "total project" restoration. Preference for funding of projects is targeted first to residential projects; second to cultural, retail, and restaurant projects; and third to other types of projects. Eligibility criteria include listing on the National Register of Historic Places and zoning as a Historic Preservation Overlay (HPO) property. Presently, there are over 220 structures potentially eligible for program funding, including the districts of Myers Park, Calhoun Street, and Park Avenue. The HPGL Program carry forward cannot exceed $300,000 in any year.

FY2017 Budget: $300,000

Water and Sewer System Charge and Tap Fee Waivers

This project provides funding for the waiver of water and sewer system charges for all affordable housing (as defined by City Code Section 21-152) and tap fee waivers for affordable home ownership units.

FY2017 Budget: $50,000

Business Enterprise Systems Upgrade and Support